When it comes to your council tax, moving house means you have to formally break up with your old council. Your account doesn't just follow you to your new place. You need to officially close the account for the property you're leaving and, if you're moving into a different council area, set up a brand new one from scratch. This is the only way to make sure you're only billed up to the day you move out.

Understanding Your Council Tax Transition

With so much to juggle during a move, it’s easy to let council tax slip down the to-do list. But putting this off is a mistake. If you don't act quickly, you could end up getting billed for a property you no longer live in. On the flip side, a prompt notification might even land you a refund if you've paid your bill in advance for the month.

Think of it as officially cutting the financial cord to your old address. Your legal liability for council tax ends the day you leave, but only once you’ve told the council. Getting this done protects you from any future bills or, worse, recovery action for someone else's debt.

Why You Need to Tell Them Straight Away

The moment you have a confirmed moving date, get in touch with your council. Being proactive prevents any mix-ups and ensures the billing responsibility is handed over to the new resident or landlord without any gaps. This is more important than ever, as councils are cracking down on empty properties.

Recent government data paints a clear picture: there were 542,000 empty homes recorded in England as of October 2025, which is an 8.0% jump from the year before. Because of this, many councils have scrapped the grace periods they once offered for unoccupied properties. This means the full council tax charge can kick in the very day you move out.

Here's the bottom line: your responsibility for the bill doesn't stop just because you've handed back the keys. You have to go through the official notification process to get your account closed and receive a final, correct bill.

What Happens After You've Notified the Council?

Once you’ve informed the council you're on your way out, they'll get to work on a final calculation. This works out precisely what you owe right up to your departure date.

From there, you can expect a few things to happen:

- A Final Bill Arrives: The council will send a closing statement showing your final balance. This could be zero, an outstanding amount, or even a credit.

- A Refund if You've Overpaid: If your Direct Debit payments were a bit ahead of the game, you'll be in credit. The council will refund this, usually sending a cheque to your new address or making a bank transfer.

- Your Old Account is Closed: With the final bill settled, the account for your old property is officially shut down, giving you a clean break.

Ticking this bit of admin off your list early is one of the smartest things you can do during a move. Our complete moving in checklist for the UK can help you keep track of everything, from sorting utilities to council tax, making the whole process feel much more manageable.

How to Notify Your Council You’re Moving

Right, let's get this sorted. Telling the council you’re on the move is one of those crucial moving admin tasks you can get ticked off your list pretty quickly, provided you have the right details to hand.

These days, almost every local authority has a simple online form, which is genuinely the fastest way to handle your council tax moving out notification. These forms are designed to be user-friendly, and you can usually find them by popping "council tax moving" into the search bar on your local council's website. Whether you're in Bristol or Bath, the process is pretty much identical.

Getting Your Details in Order First

Before you even click on the form, take a few minutes to get your information together. It’s a simple bit of prep that stops you from frantically searching for old bills halfway through.

Here’s what you’ll almost certainly need:

- Your Council Tax Account Number: You’ll find this printed clearly on any of your old bills.

- Your Full Address and Postcode: The one you're moving out of, of course.

- Your Exact Moving Out Date: This is the day your tenancy ends or the sale completes, marking the end of your liability.

- A Forwarding Address: This is non-negotiable. Without it, your final bill and any refund you might be owed will end up at your old place.

- New Occupants' Details (if known): If you happen to know the name of the new owner or tenant, adding it can help the council join the dots faster.

Having all this ready means the whole thing can be done and dusted in just a few minutes.

A Pro Mover's Tip: Always, always get a confirmation. Whether it’s an email, a PDF download, or a submission reference number, save it. If there’s ever a dispute down the line about when you notified them, this little digital receipt is your proof.

Can’t Get Online? Other Ways to Notify Them

While the online portal is the gold standard, it’s not the only way. If you’re not comfortable online or just can’t get access, you can still get in touch the old-fashioned way: by phone or post.

If you decide to call, have all the same information ready that you'd need for the online form. Just be prepared for a bit of a wait on hold, and don't hang up without getting a reference number for the call from the advisor.

Prefer to send a letter? Keep it brief and to the point. Clearly state your name, the property address, your account number, the date you're moving, and your forwarding address. I'd strongly recommend sending it via recorded delivery—that way, you have concrete proof it arrived safely.

Letting the council know is just one piece of the puzzle. For a full checklist of everyone you need to contact, our guide on who to notify when you move is a real lifesaver. It helps ensure no important mail gets lost and you can make a truly clean break from your old home.

Understanding Your Final Bill and Closing Your Account

Once you've told the council you're moving, the next thing to land on your doormat (or in your inbox) will be your final council tax statement. It can look a bit confusing at first, but don't worry. It's just the council's way of settling up your account for the exact number of days you were liable for the property.

At its core, the calculation is pretty simple. The council works out a daily rate by dividing your total annual bill by 365. They then multiply this daily rate by the number of days you were actually living at the property during that financial year. Any payments you've already made are knocked off this total.

How Your Final Bill Is Calculated

Let’s run through a common scenario. Say you're moving out of a Band B flat in Bristol on the 15th of the month. Your Direct Debit for the full month has already gone out as usual.

- Your final bill will be adjusted to show you're only liable for the first 15 days.

- The payment you made for the rest of the month (from the 16th onwards) will be credited back to your account.

- This credit means you'll either have a £0 balance or, more often than not, you'll be due a refund.

It all boils down to one simple rule: you only pay for the time you are legally responsible for the property. This process ensures everything is settled fairly when you're dealing with your council tax moving out duties.

Key Takeaway: Always, always give the council your forwarding address. If they owe you a refund, they’ll usually post a cheque. Without that new address, you could easily miss out on getting your money back.

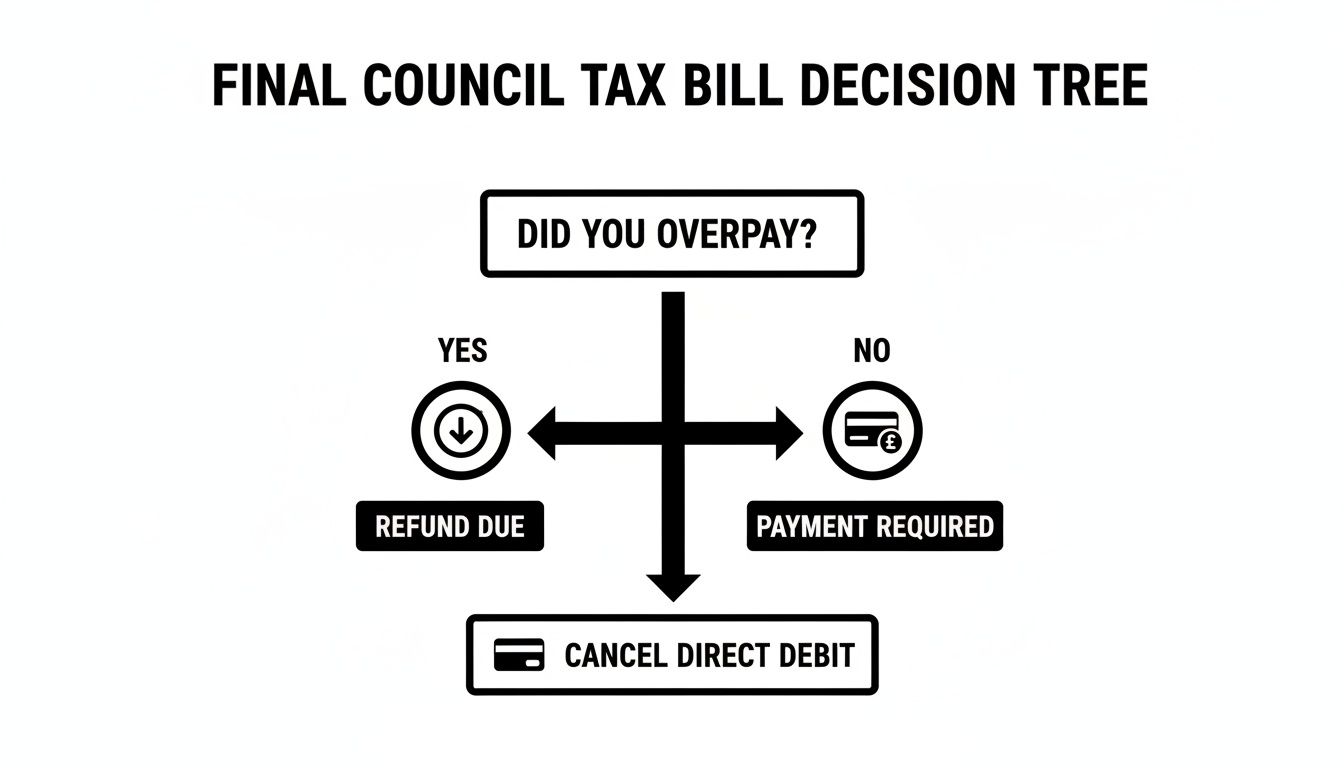

The Final Step: Cancelling Your Direct Debit

This last part is crucial, and the timing is everything. It’s so tempting to cancel your Direct Debit the moment you've sent your notification, but hold fire. The golden rule is to wait until you have that final bill in your hands confirming a £0 balance or that a refund is on its way.

Jumping the gun and cancelling too early can create a real headache. If it turns out you owe a small, final amount, a failed payment could trigger late fees and unnecessary hassle. Wait for that final piece of paper confirming the account is all square, and only then should you log into your online banking to cancel the instruction.

To help make sure your move-out goes smoothly and you get a fair final bill, it's wise to avoid any disputes over the property's condition. Both landlords and tenants will find a detailed landlord move-out inspection checklist incredibly useful here. For a complete rundown of all the other little jobs you need to tick off, our checklist to move out has you covered from start to finish.

Council Tax Rules: Tenants vs. Landlords

Figuring out who pays the council tax when you're moving can be a bit of a headache. It all comes down to the tenancy agreement, and there's a common trap many tenants fall into.

Lots of people assume their responsibility ends the moment they drop off the keys. But that’s not how it works. Your liability is tied to the official end date of your tenancy, not the day you physically leave the property.

So, if you move out on the 10th of the month but your notice period doesn't finish until the 31st, you’re on the hook for the council tax right up to that final date. It’s a small detail that can lead to a surprise bill if you're not careful.

For landlords, the main thing to worry about is the "void period" – that gap when the property is empty between tenants. During this time, the responsibility for the council tax flips back to the owner.

What Landlords Need to Know About Void Periods

As soon as a property is empty, the landlord becomes liable for the council tax. It used to be common for councils to offer a discount or a short exemption period, but those days are largely gone.

Now, most local authorities will charge 100% of the council tax from day one of a property being vacant. This is a deliberate policy to encourage landlords to fill empty homes quickly. If you're a landlord, you absolutely must factor this potential cost into your budget when tenants are changing over.

The HMO Exception

There's one big exception to the 'tenant pays' rule: a House in Multiple Occupation (HMO). For council tax purposes, an HMO is typically a property where tenants have their own room but share common areas like the kitchen and bathroom, all on separate tenancy agreements.

In this setup, the council tax liability always sits with the landlord, never the individual tenants. Because no single person has a lease for the entire property, the council sends one bill for the whole house directly to the owner. The landlord usually just rolls this cost into the monthly rent for each room.

Once you get your final bill and your old account is closed, what happens next? This flowchart makes it simple.

It’s a handy visual guide to see whether you’ll be getting a refund for overpayment or if you need to settle a final amount.

How to Protect Yourself During the Handover

For tenants, the critical takeaway is this: know your tenancy end date, not just your moving date. For landlords, be ready for the council tax bill to land in your name the very day the tenancy officially ends.

Here's a pro tip for both sides: get the end-of-tenancy date confirmed in writing. A simple email trail can be a lifesaver if the council later questions who was responsible for the bill during the changeover period. Crystal-clear dates leave no room for argument and protect everyone involved.

By getting a grip on these roles and responsibilities, both tenants and landlords can navigate the move without any nasty financial surprises.

Uncovering Council Tax Discounts and Exemptions After Your Move

Moving house is the perfect trigger to take a fresh look at your council tax bill. Your circumstances are changing, and that shift could open the door to some serious savings. It's something many people overlook, but a change in who you live with can have a big impact on what you owe.

The most common saving by far is the Single Person Discount. If you’re moving out of a shared flat or leaving the family home to live on your own, you can get a hefty 25% reduction on your bill. Make sure you apply for this with your new council the moment you register – don’t wait for them to ask.

It's also worth looking beyond just council tax. Depending on your new situation, you might qualify for other housing-related support. Using something like a rent allowance calculator can give you a clearer picture of what else you might be entitled to, which can make a real difference to your monthly budget.

When a Property is Completely Exempt from Council Tax

In certain cases, a property can be fully exempt from council tax. These situations are quite specific, but it's crucial to know about them in case one applies to you during your move.

Here are a few scenarios where this might come up:

- Homes occupied only by students: If the property is solely occupied by full-time students, it's generally exempt.

- A move into long-term care: If someone has to move permanently into a hospital or a care home, their old house can often be made exempt from council tax.

- Properties owned by a charity: A home owned by a charity can be exempt for up to six months, as long as it remains unoccupied.

Each council has its own strict rules for these exemptions. You'll need to provide evidence, like an official student status letter or confirmation from a care facility, so always check their website for the exact requirements.

A change in living arrangements is the number one trigger for council tax discounts. In England alone, 8.5 million dwellings now receive a single-person discount, a figure that often rises when one person moves out of a shared home.

Handling Gaps Between Moving Dates

What happens if you move out but the property sits empty for a while? This is a common worry for homeowners, especially when there’s a gap between selling your old place and getting the keys to the new one.

Years ago, you could expect a discount for an empty and unfurnished property, but those days are largely gone. Most councils now charge the full 100% council tax from the day a property becomes empty. A few might offer a short grace period, perhaps up to a month, but it's rare.

Worse, if the property stays empty for a long time, you could be hit with an "empty homes premium," which can double your bill. This is why timing your council tax moving out notification is so important – you want to avoid paying a penny more than you have to for a property you're no longer living in. Policies do vary by region, so it’s always worth checking the local rules.

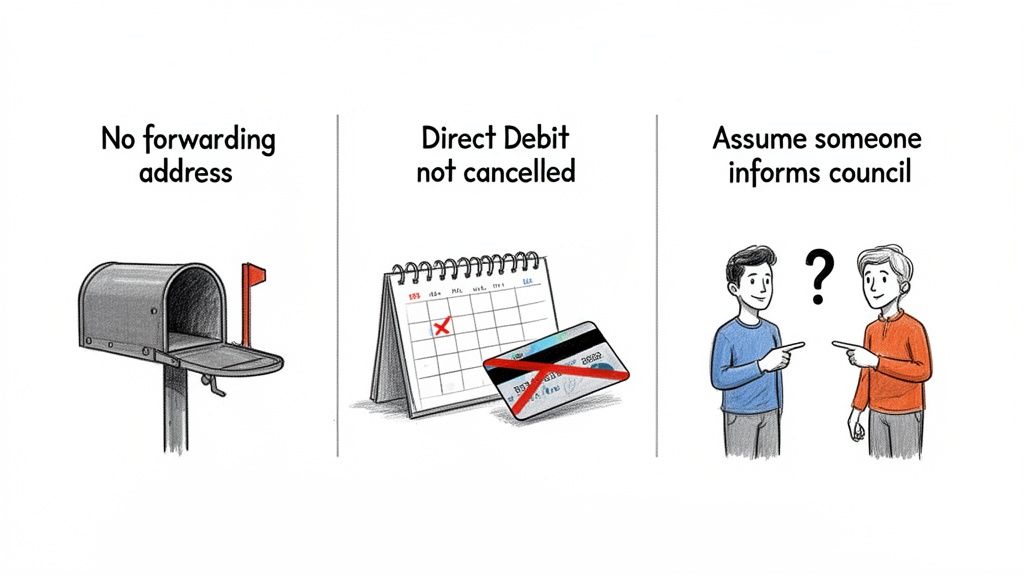

Common Moving Mistakes That Affect Council Tax

When you're caught up in the chaos of moving, it's the small details that can come back to bite you. We've helped countless people navigate their relocations, and we see the same few council tax tripwires time and time again. The good news? They’re easy to avoid once you know what to look out for.

The number one mistake is assuming someone else has it covered. Don't fall into the trap of thinking your landlord, the estate agent, or even the new owner will tell the council you've left. That responsibility is yours and yours alone.

Forgetting Your Forwarding Address

This is a classic blunder, and it's a big one. If you don't give the council your new address, where will they send your final bill? More importantly, where will they send your refund cheque if you've overpaid?

The last thing you need is sensitive financial mail being sent to your old home. Always provide a reliable forwarding address so you get that final statement and, crucially, any money you're owed.

A Word of Warning: Don't put this off. Local councils are under huge pressure to chase every penny, especially as bills are on the rise. If you delay telling them you've moved, you risk being slapped with an empty property premium, a penalty that can even double your bill.

It's also worth remembering that council tax rates are climbing steeply. For the 2025-26 period, the average Band D council tax in England is expected to reach £2,280. In some county areas, it's even higher as central government funding shifts. This financial pressure means councils are more diligent than ever about tracking who lives where. You can explore the latest council tax data to see how your area is affected.

Mishandling Your Final Payment and Direct Debit

I get it. It’s tempting to cancel your Direct Debit the moment the moving van drives away. But hold fire.

Wait until you have that final, official closing statement from the council in your hands. This document is your proof. It will clearly state whether you owe a final small amount, your balance is zero, or you're due a refund.

If you cancel the payment instruction too soon, you could accidentally miss a final payment. That leads to admin fees, reminder letters, and a headache you just don't need. Settle up first, get that final bill, then cancel the Direct Debit for a clean break.

Your Council Tax Moving Questions, Answered

Moving house always brings up a few tricky questions about council tax. After helping thousands of people move, we’ve pretty much heard them all. Here are the most common queries we get, with some straightforward answers to help you out.

How Far Ahead Should I Tell the Council I’m Moving?

The best time to let your council know you're moving is as soon as you have a confirmed date. Most councils will let you report a move up to a month in advance, and giving them this heads-up is a great way to make sure your final bill is sorted out accurately and on time.

If it's a last-minute move, don't worry. Just be sure to tell them on the day you leave or as soon as you possibly can right after. The main thing is to keep your liability dates spot on.

What Happens If I Forget to Tell the Council I’ve Moved?

Forgetting to notify the council is a classic moving blunder, and honestly, it can cause a real mess. If you don't tell them, you'll keep getting billed for a property you no longer live in. If those bills then go unpaid, it could escalate to recovery action.

You might also miss out on a refund if you happen to be in credit. It’s a simple bit of admin that saves you, and the new residents, a lot of potential hassle down the line.

Key Takeaway: Your legal responsibility for council tax doesn’t stop just because you've handed back the keys. It only officially ends when you've notified the council and they've closed your account.

I’m Moving to a Different Council Area – Who Do I Tell?

This is a really common point of confusion. You actually have to contact both councils. Your council tax account isn't like a bank account that you can just transfer; each local authority is separate.

Think of it as a clear two-step process:

- Tell your old council that you are moving out. This is purely to close your existing account.

- Contact your new council to register. This sets up your new account from the day you move in.

Do I Pay Council Tax if My Stuff Is in Storage?

Nope, you don't. Council tax is a charge on a residential property, not on where your belongings are. Once you've moved out of your old home, your council tax liability for that address ends (as soon as you've told them, of course!).

You won't be liable for council tax again until you're officially living in your next home. A storage unit is a commercial space, so it isn't subject to residential council tax at all.

Sorting out the admin is just one piece of the moving puzzle. For a smooth ride from the first box to the last, you need experts you can trust. SimplyPro Removal & Storage Ltd provides professional, reliable removals and secure storage across Bristol and Bath. Get a free, no-obligation quote today and let us do the heavy lifting. Find out more at https://www.simplyremovalsbristol.co.uk.